A reader emailed me about a difficult exam he was facing. The test was for a prestigious civil service job in his country. Get one of those jobs, and you’re set for life.

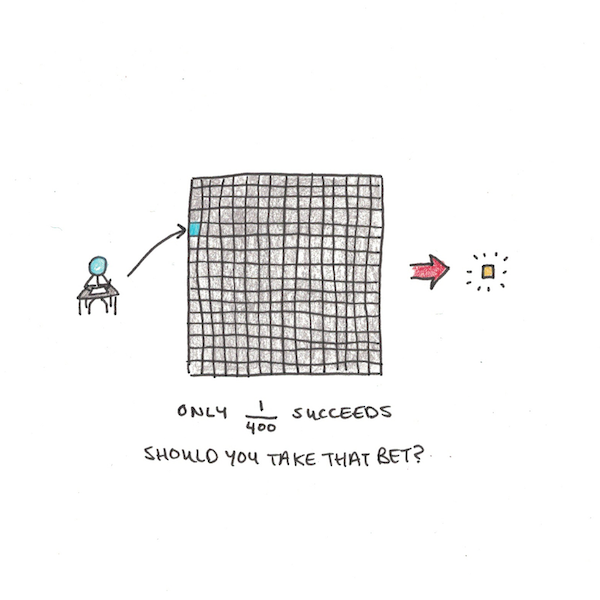

Unfortunately, competition was also steep. About four hundred people compete, and only the best scorer on the test gets the spot. Applicants spend around two years studying full-time for one of these positions, many of whom have access to expensive test-preparation services.

What should he do?

My advice here may sound like a bummer, but I told him to seriously consider whether he even wants to apply for the spot. Why?

When Second-Best Isn’t Good Enough

Compare the situation faced by this reader from a seemingly similar situation: an American high-schooler looking to write the SAT. Say she wants to go to Harvard, which has an acceptance rate of around 4.5%.

Already, we can see a big difference. Getting into Harvard is, proportionally, about 20 times easier than getting the civil service spot. Admittedly, the competitive strength of the applicant pool may be different. However, this data point is still useful to scale your intuitions.

However, even if Harvard’s acceptance rate were identical—only 0.25%—the situations here would be still quite different. Why?

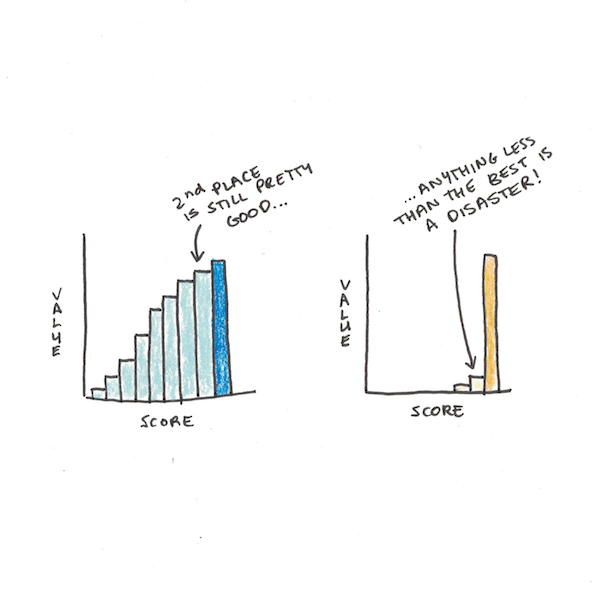

The answer is that getting a good SAT score is still really helpful, even if you don’t get into Harvard. Suppose you were just shy of the cutoff value of getting accepted. In that case, you’d still be in a really good position to get into another good school. Even if you had to compromise and go to a somewhat less-prestigious school, that almost-Harvard SAT score would help.

My understanding of the situation given by this reader, in contrast, was that the exam was really only applicable to these rare, civil service jobs. If you got second place, the value of an almost-good-enough score is nearly worthless. It won’t help you get a different job in the private sector.

Mistakes When Thinking About Risk

There’s a certain, naive way of thinking about risky decisions that simply asks how likely it is that you’ll get what you want. When this is low, the effort is probably not worth it.

However, when we look at successful people, they’ve often taken many of these gambles and had it pay off. Thus, the world tends to be split between people who say that the successful are simply lucky, and the people who think that being successful requires believing in yourself and ignoring the odds. Both mindsets are wrong.

The problem isn’t that the odds don’t matter. Rather, the difficulty is that we often think about risk in an overly simplistic way.

The key difference between taking the SAT to get into Harvard, and taking the civil service exam to get a rare spot wasn’t just the difficulty. Instead, it was the fact that, in the first case, striving still pays off even if you fail to reach your original goal.

Consider another common risky decision: should you start a new company? Once again, a sober analysis reveals that failure rates are quite high. Most start-ups fail.

Once again, it seems like we’re torn. Either we think successful founders are like lottery winners—people who got lucky at an otherwise bad bet—or, we think the right approach is just to ignore the risks and do it anyways.

Yet this misses an essential fact about start-ups: most failures lead to better things. Many people I know who had “failed” start-ups, were able to translate those into new connections, better job opportunities or even another company. Yes, failing still sucks, but the median outcome isn’t nearly as bad as it seems.1

Model Your Decisions

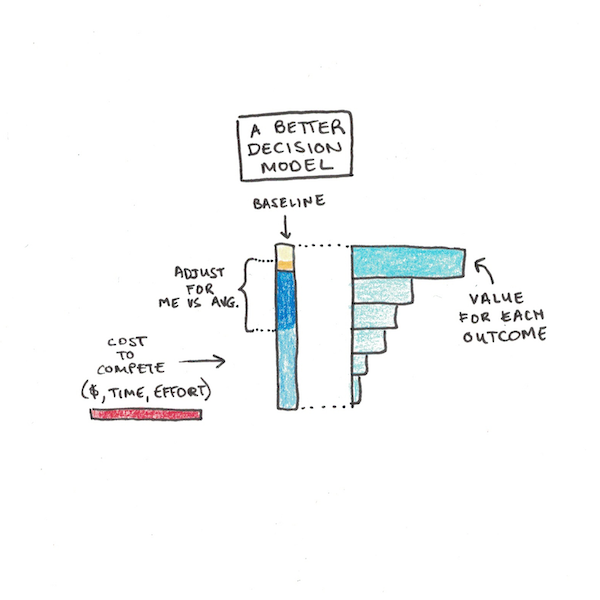

The correct approach to thinking about risky decisions is not to ignore the odds, but to model your decision and explicitly include things like the benefits to coming in second place.

A good decision model ought to include:

- What is the baseline likelihood of success? This can come from reported statistics for that kind of activity. (Say typical failure rates for start-ups, typical acceptance rates for Harvard, etc.)

- What information do you have that makes you different from the average competitor? How far are you from the score you need? People tend to be overconfident, but this bias is a lot worse when it’s not confronted explicitly.

- What are the outcomes for less-than-ideal results? What if you don’t get into Harvard? What if your start-up fails to return a profit for the investors? These can be less obvious, but they can easily turn a seemingly bad bet into a good one if the modal outcome for a “failure” is still pretty good.

- What are the emotional and financial cost of going forward? The person who plays hockey seriously, hoping to join the NHL, may have a minuscule chance of success. But if he still really enjoys playing competitively, the time spent might not be wasted. In contrast, the person studying for an exam who expects the next couple years of effort to be miserable can’t say they did it for fun.

Now we can see that a lot of risky decisions look quite different from their probabilities of success alone. Even if the odds of your ideal outcome are low, if the outcomes for failure are still pretty good, the costs are minimal or you’re a stellar competitor, then the gamble is often totally reasonable.

Given these additional factors, I hope it makes sense why I told the reader to consider his decision to pursue carefully.

With a 1/400 shot of success, two years of arduous studying required, and few benefits for second place, he must believe he’s really quite superior to the typical competitor for this gamble to pay off. Even if he was in the top 10% of test-takers, his odds are still 1/40, which is still less than getting into Harvard. Top 1%, and his odds are a little better than rolling a die.

Of course, my modeling of his decision might be off. Perhaps there are benefits to second place outcomes that I don’t know about. Maybe many applicants take the test without studying because they know it’s a long-shot, and thus the denominator is inflated with low-value candidates.2 Maybe he can take the test several times with the same studying effort, making success increasingly certain.

My point isn’t that I have the right answer for his situation which, I admit, I know little about. Rather, I think being more explicit in modeling the risky decisions you face can make a huge difference in your life. The person who doesn’t bother applying to Harvard because “there’s no way I’ll ever get in” might be missing an opportunity.

Both the pessimist, who sees all success as being the result of lucky wins from irrational risk-takers, and the optimist, who chooses to ignore the odds are making mistakes. If you take the effort to model the risks you face, you’ll make much better decisions.

Footnotes

- Obviously, this depends. Taking out a lot of debt personally to fund a new business may ruin you financially for a long-shot at success. Similarly, the type of business matters greatly. Starting a laundromat isn’t going to lead to getting bought out and landing a decent salaried position instead.

- Many job applications are like this. Most competitors are spamming their resume even though they’re not remotely a good candidate, so if you reasonably meet the criteria, your odds might be 10x or 100x as good as a naive estimate would make.

I'm a Wall Street Journal bestselling author, podcast host, computer programmer and an avid reader. Since 2006, I've published weekly essays on this website to help people like you learn and think better. My work has been featured in The New York Times, BBC, TEDx, Pocket, Business Insider and more. I don't promise I have all the answers, just a place to start.

I'm a Wall Street Journal bestselling author, podcast host, computer programmer and an avid reader. Since 2006, I've published weekly essays on this website to help people like you learn and think better. My work has been featured in The New York Times, BBC, TEDx, Pocket, Business Insider and more. I don't promise I have all the answers, just a place to start.